Get the free ftb 4579 form

Show details

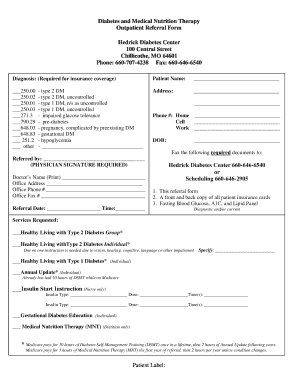

Attachment 23 Michigan Department of Treasury 4579 Rev. 06-11 Page 1 2011 MICHIGAN Business Tax Qualified Affordable Housing Seller s Deduction Issued under authority of Public Act 36 of 2007. PART 1 SELLER/BUYER IDENTIFICATION Note Seller must obtain buyer s signature and attach this form and a copy of the buyer s operation agreement to the seller s MBT Annual Return Form 4567. 0000 2011 55 01 27 2 4579 Page 2 Instructions for Form 4579 Michigan...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ftb 4579 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ftb 4579 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ftb 4579 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ftb 4579. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out ftb 4579 form

How to fill out ftb 4579?

01

Gather all the necessary information and documents required to complete the form.

02

Start by filling out the top section of the form, providing your personal details such as name, address, and Social Security number.

03

Enter the tax year and any other relevant details requested in the form.

04

Proceed to complete each section of the form according to the instructions provided. This may include reporting income, deductions, credits, and any other relevant information.

05

Double-check all the information entered to ensure accuracy and completeness.

06

Sign and date the form, and provide any additional information or documentation required.

07

Keep a copy of the completed form for your records.

Who needs ftb 4579?

01

Individuals who have incurred California tax liabilities and need to report that information to the Franchise Tax Board (FTB).

02

Taxpayers who have received a notice from the FTB requesting completion of form ftb 4579.

03

Individuals who have a financial interest in, or signature authority over, one or more foreign financial accounts and need to comply with reporting requirements set forth by the FTB.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ftb 4579?

The FTB 4579 is a form used for requesting relief from penalties and interest for late or insufficient payment of California state taxes.

Who is required to file ftb 4579?

Individuals or businesses who have late or insufficient payment of California state taxes may be required to file FTB 4579.

How to fill out ftb 4579?

To fill out FTB 4579, you need to provide your contact information, tax account number, the tax year or period in question, and explain the reason for the late or insufficient payment. You should also provide any supporting documents or evidence.

What is the purpose of ftb 4579?

The purpose of FTB 4579 is to request relief from penalties and interest that may be imposed for late or insufficient payment of California state taxes.

What information must be reported on ftb 4579?

On FTB 4579, you must report your contact information, tax account number, the specific tax year or period in question, and provide a detailed explanation of why you believe you are entitled to relief from penalties and interest.

When is the deadline to file ftb 4579 in 2023?

The deadline to file FTB 4579 in 2023 may vary depending on your specific circumstances. It is recommended to consult the California Franchise Tax Board for the exact deadline.

What is the penalty for the late filing of ftb 4579?

There is no specific penalty mentioned for the late filing of FTB 4579. However, failure to file the form may result in penalties and interest being imposed on the late or insufficient payment of California state taxes.

How do I complete ftb 4579 online?

pdfFiller has made it simple to fill out and eSign ftb 4579. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit ftb 4579 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign ftb 4579 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit ftb 4579 on an Android device?

You can make any changes to PDF files, like ftb 4579, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your ftb 4579 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.